If you’re running a business in Peru or offering tax-related services, staying on top of SUNAT requirements can be a real challenge. That’s where the Sunat Plugin for WordPress comes in handy! This nifty tool simplifies your tax management by integrating SUNAT functionalities directly into your website. Whether you need to generate electronic invoices, submit tax documents, or stay updated on regulations, this plugin is a game-changer. It saves you time, reduces errors, and helps ensure compliance—all without leaving your WordPress dashboard. So, let’s explore how this plugin can make your tax tasks smoother and more efficient.

Step-by-Step Guide to Installing the Sunat Plugin in WordPress

Getting started with the Sunat Plugin is straightforward, even if you’re not a tech wizard. Here’s a simple step-by-step guide to help you install and set it up:

- Backup Your Website – Before making any significant changes, it’s always a good idea to back up your WordPress site. This way, you can restore everything if something doesn’t go as planned.

- Log into Your WordPress Dashboard – Head over to your website’s admin panel by visiting yourdomain.com/wp-admin and entering your credentials.

- Navigate to Plugins – On the left sidebar, click on Plugins and then select Add New.

- Search for the Sunat Plugin – In the search bar, type Sunat or Sunat Plugin. Look for the official plugin or one with good reviews and recent updates.

- Install the Plugin – Click the Install Now button next to the plugin, then wait a few moments for WordPress to download and install it.

- Activate the Plugin – Once installed, click on Activate. The plugin is now ready to be configured.

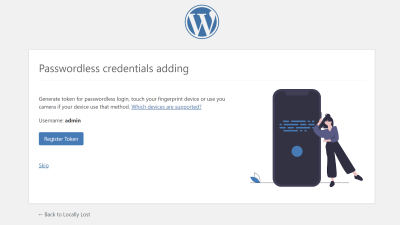

- Configure the Plugin Settings – After activation, usually a new menu item or settings link appears. Click on it to access configuration options.

- Connect to SUNAT – You’ll need to input your SUNAT credentials, API keys, or certificates, depending on the plugin’s requirements. Follow the on-screen instructions carefully.

- Test the Integration – Before going live, generate a test invoice or submission to ensure everything is working correctly. Most plugins provide a sandbox or testing mode.

And that’s it! With these steps, you’ll have your Sunat Plugin installed and ready to help manage your Peruvian tax submissions seamlessly. Remember, always keep your plugin updated and consult the official documentation if you run into any issues. Happy taxing!

3. Configuring the Sunat Plugin for Your Business Needs

Now that you’ve installed the Sunat plugin in your WordPress site, it’s time to make sure it’s set up just right for your business. Proper configuration is key to ensuring smooth tax document management and compliance with Peruvian tax regulations.

First things first, head over to the plugin’s settings menu. You’ll usually find this under the WordPress dashboard sidebar, often labeled as “Sunat Settings” or something similar. Here, you’ll be greeted with a variety of options to personalize the plugin for your specific needs.

Some of the main configuration steps include:

- Entering your RUC number: This is the unique taxpayer identification number assigned by SUNAT. Double-check it for accuracy to avoid issues later.

- Setting your environment: Choose between testing (sandbox) and production modes. Start with testing to ensure everything works smoothly before going live.

- Configuring your certificates: The plugin often requires your digital certificate (.pfx or .cer files). Upload these securely and input passwords if prompted.

- Adjusting document preferences: Select which types of documents you’ll be issuing—such as invoices, receipts, or credit notes—and customize the formats if needed.

Additionally, review the communication settings. The plugin might need API credentials or access tokens from SUNAT. These are essential for transmitting documents. If you haven’t obtained them yet, you’ll need to register for a SUNAT service account and generate the necessary credentials.

Don’t forget to set up notifications or alerts within the plugin. This way, you’ll get notified if submissions fail or if there are errors to address.

Lastly, save your settings and do a quick test. Generate a mock invoice or document to see if everything is configured correctly. Remember, taking the time to fine-tune these settings now will save you headaches down the road and ensure your business remains compliant with Peruvian tax laws.

4. How to Generate and Submit Tax Documents Using the Sunat Plugin

Great! Your plugin is configured, and you’re ready to start issuing and submitting tax documents. Here’s a simple step-by-step guide to help you generate and send those important files through the Sunat plugin.

Step 1: Create a New Document

Navigate to the plugin’s section within your WordPress dashboard, usually labeled “Tax Documents” or “Sunat.” Click on “Add New” or “Create Document.” Here, you’ll fill in essential details such as:

- Customer’s RUC and details

- Type of document (invoice, receipt, credit note, etc.)

- Date of issue

- Description of goods or services

- Total amount and applicable taxes

Most plugins have pre-designed forms that make this process straightforward. Double-check all entries for accuracy to prevent rejections.

Step 2: Generate the Electronic Document

Once all data is entered, click on “Generate” or “Create PDF” depending on your plugin’s terminology. The system will compile the information into an XML file compliant with SUNAT standards and often generate a PDF version for your records.

Some plugins also allow you to preview the document before submission, which is a good opportunity to verify everything looks correct.

Step 3: Sign the Document Digitally

For legal compliance, your documents typically need to be digitally signed. The plugin should handle this automatically if you’ve uploaded your certificates during setup. If not, follow the plugin’s instructions to sign the document manually or automatically.

Step 4: Submit to SUNAT

With the document ready and signed, it’s time to send it to SUNAT. Look for the “Send” or “Transmit” button within the plugin. The system will connect to SUNAT’s servers and attempt to upload the document.

If the submission is successful, you’ll receive an acknowledgment or receipt number. Save this for your records and future reference.

In case of errors or rejection, the plugin should provide a detailed error log. Common issues might include incorrect data, missing fields, or certificate problems. Review the feedback carefully, correct the issues, and try submitting again.

Remember, regularly generating and submitting your tax documents through the Sunat plugin not only keeps your business compliant but also streamlines your accounting process. With practice, this process becomes quick and seamless, giving you more time to focus on what you do best—running your business!

5. Troubleshooting Common Issues with the Sunat Plugin

Sometimes, even the most well-designed plugins can run into hiccups, and the Sunat plugin for WordPress is no exception. If you’re experiencing issues, don’t worry — many problems have straightforward solutions. Let’s walk through some common issues and how to resolve them.

Issue 1: Plugin Not Generating Correct XML Files

This is a common concern because Sunat requires specific XML formats for electronic invoices and receipts. If your plugin isn’t generating the right XML, check the following:

- Data Accuracy: Ensure all customer and transaction data are correctly entered and formatted.

- Plugin Configuration: Verify your plugin settings match your business type and tax requirements.

- Updates: Make sure you’re running the latest version of the plugin, as updates often fix bugs and improve compliance.

If issues persist, try clearing your cache, regenerating the XML, or reviewing your input data for errors.

Issue 2: Authentication Problems with Sunat

Sometimes, the plugin may have trouble connecting with Sunat’s servers, resulting in authentication errors. To troubleshoot:

- API Credentials: Double-check your Sunat API credentials entered in the plugin settings.

- Network Connectivity: Ensure your hosting server can connect to external servers without restrictions or firewall issues.

- Certificate Validity: Confirm your SSL certificates are up-to-date and correctly installed.

If you’re still facing problems, contact your hosting provider to ensure there are no network restrictions, or consult Sunat’s technical support for credential verification.

Issue 3: Plugin Conflicts or Errors

Conflicts with other plugins or themes can cause unexpected errors. To troubleshoot:

- Deactivate Other Plugins: Temporarily disable other plugins to identify conflicts.

- Switch Themes: Try switching to a default WordPress theme like Twenty Twenty-Three to see if the issue persists.

- Enable Debugging: Turn on debugging in WordPress to get more detailed error messages, which can guide you to the root cause.

If conflicts are identified, consider reaching out to plugin developers or a WordPress professional for assistance.

Issue 4: Not Receiving Confirmation or Acceptance from Sunat

Sometimes, the plugin sends data but doesn’t get the expected acknowledgment. In this case:

- Check Submission Status: Log into Sunat’s portal manually to verify if your documents are received and accepted.

- Review Error Messages: The plugin should provide logs or error messages — review these for clues.

- Retry Submission: If the issue is temporary, try resubmitting the document.

Persistent issues might require contacting Sunat support or updating your plugin to ensure compatibility with their latest standards.

6. Best Practices for Maintaining Compliance with Peruvian Tax Regulations

Staying compliant with Peruvian tax laws isn’t a one-time task — it’s an ongoing process. Implementing best practices not only keeps you out of trouble but also simplifies your accounting and audit processes. Here are some tips to help you stay on the right side of the law:

1. Keep Your Software Up-to-Date

Always use the latest version of the Sunat plugin and your WordPress core. Developers regularly release updates that patch security issues, enhance features, and ensure compliance with new regulations.

2. Maintain Accurate and Complete Records

Ensure all your invoices, receipts, and related documents are accurate, properly formatted, and stored securely. Proper record-keeping is essential for audits and tax filings.

3. Regularly Review Sunat Compliance Guidelines

Tax laws evolve, and Sunat publishes updates periodically. Make it a habit to review their official communications and guidelines so your processes remain aligned.

4. Automate Reporting and Submissions

Leverage your plugin’s automation features to submit documents promptly. This reduces errors and ensures compliance deadlines are met.

5. Conduct Periodic Internal Audits

Periodically review your invoicing and tax reporting processes to identify and correct issues early. This proactive approach helps prevent penalties and fines.

6. Train Your Team

Ensure your staff understands the importance of compliance, how to use the Sunat plugin correctly, and what to do if issues arise. Regular training minimizes mistakes and builds confidence.

7. Seek Expert Advice When Needed

If you’re unsure about specific regulations or face complex issues, consult with a tax professional familiar with Peruvian laws. Their guidance can save you time and money in the long run.

By following these best practices, you’ll not only keep your business compliant but also streamline your tax processes, making your operations smoother and less stressful. Staying proactive and informed is the key to successful tax management in Peru!

Conclusion and Additional Resources for Peruvian Tax Professionals

Mastering the Sunat plugin in WordPress can significantly streamline your tax service operations in Peru. By integrating this tool, you can automate tax calculations, generate compliant invoices, and ensure your website adheres to Peruvian regulations seamlessly. Remember, staying updated with Sunat’s latest requirements is essential for maintaining compliance and providing top-notch services to your clients.

To further enhance your knowledge and skills, consider exploring the following resources:

- Official Sunat Website: Access the latest updates, guides, and documentation here.

- WordPress Plugin Repository: Download and review the Sunat plugin details and user reviews here.

- Peruvian Tax Regulations Blog: Stay informed about new tax laws and compliance tips specific to Peru.

- Online Forums and Communities: Join groups like Peruvian Tax Professionals on social media platforms for peer support and advice.

Implementing these resources and staying current with regulatory changes will empower you to provide efficient, compliant tax services. With the right tools and knowledge, leveraging the Sunat plugin can become a vital part of your Peruvian tax practice, saving time and reducing errors for your clients.